is interest on your car loan tax deductible

F the car you purchase is for personal use you cant deduct the interest you pay on a car loan from your tax return. March 13 2019.

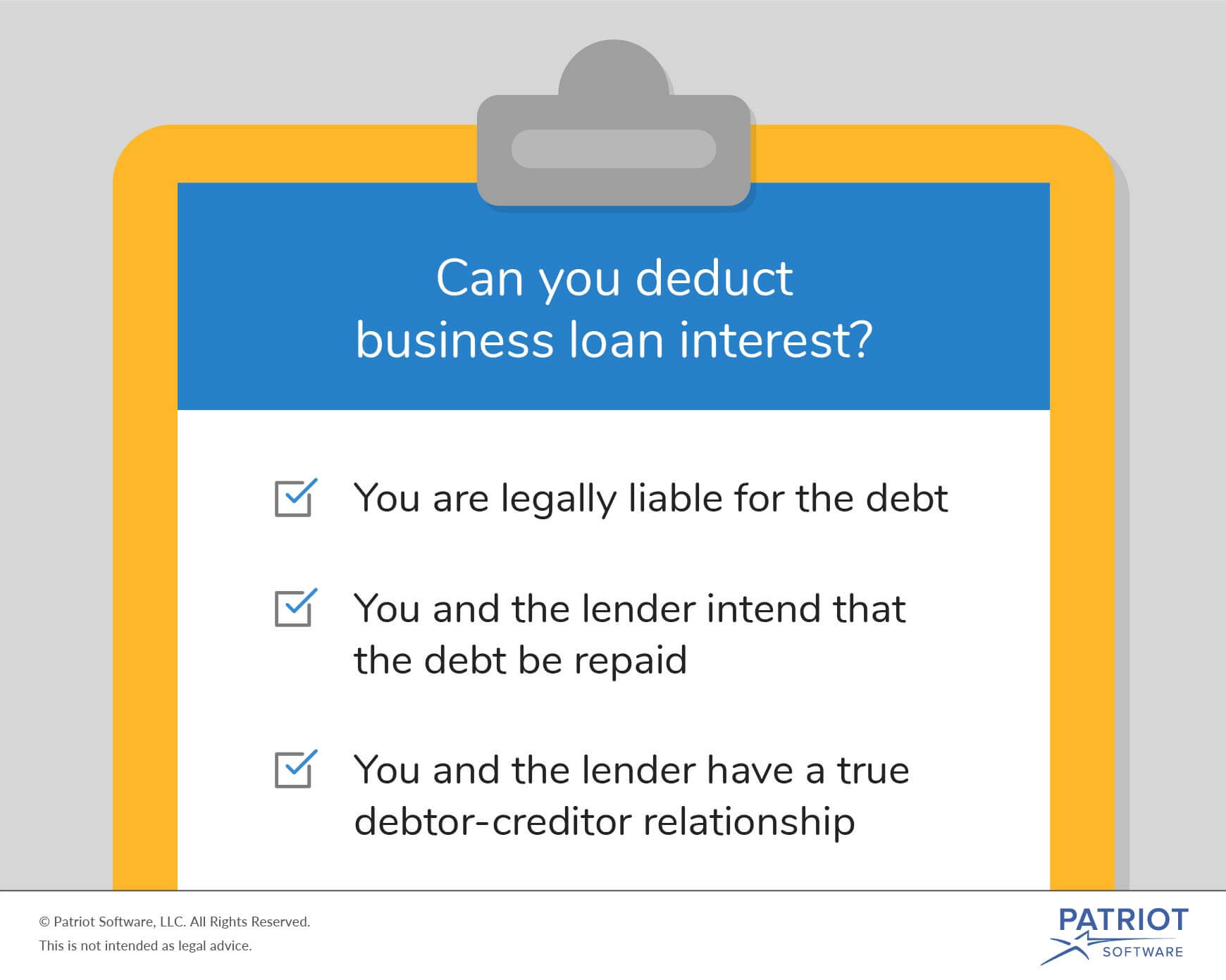

Reporting the interest from these loans as a tax deduction is fairly straightforward.

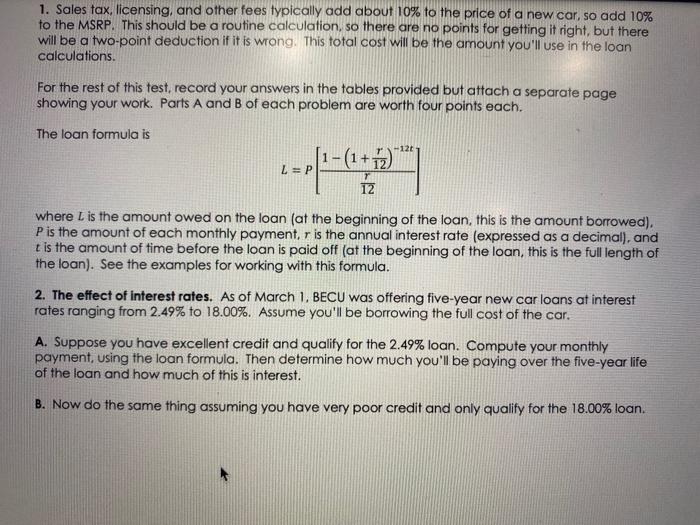

. May 10 2018. For example if you use the vehicle 50 of the time for business purposes you can only deduct 50 of the loan interest on your tax returns. For example if you use the vehicle 50 of the time for business purposes you can only deduct 50 of the loan interest on your tax returns.

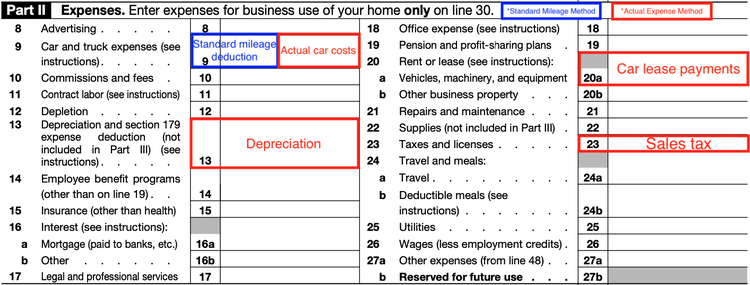

Interest on car loans may be deductible if you use the car to help you earn income. You cannot deduct the actual car operating costs if you choose the standard mileage rate. If you are an employee of someone elses business you are not eligible to claim this deduction.

Only those who are self-employed or own their own business and use a vehicle for business purposes may claim a tax deduction for car loan interest. You paid 25000 for the car and you have a 10 percent interest rate which gives you 2500 in loan interest. Should you use your car for work and youre an employee you cant write off any of the interest you pay on.

You can write off up to 100. Experts agree that auto loan interest charges arent inherently deductible. The IRS allows you to deduct the interest you pay on a loan for your car provided the vehicle is used for business purposes.

When you file your taxes with the Internal. The interest you pay on student loans and mortgage loans is tax-deductible. In addition interest paid on a loan used to purchase a car for personal use only is not deductible.

But there is one exception to this rule. Car loan interest is tax deductible if its a business vehicle. What this means is you must be self-employed own a small business.

So if you drive your car 50000 miles and 25000 of these miles are for. If this vehicle is used for both business and personal needs claiming this tax. 50 of your cars use is for business and 50 is personal.

To do this you have to keep detailed records of these expenses and the miles you drive for business. Interest on loans is deductible under CRA-approved allowable motor vehicle. If you use your car for business purposes you may be allowed to partially deduct car loan interest as.

This is why you need to list your vehicle as a business expense if you wish to deduct the interest. Unfortunately car loan interest isnt deductible for all taxpayers. The standard mileage rate already factors in costs like gas taxes and insurance.

If on the other hand the car is used entirely for business purposes the full amount of. In addition interest paid on a loan thats used to purchase a car solely for. After all interest on student loans is deductible under certain circumstances and so is interest up to a certain amount on homes.

This means that if you pay 1000 annually in interest on your car loan you can only claim a 500 deduction. Most employees cannot deduct car loan interest unless the amount is related to business use. If youre reviewing your personal finance for.

If you live in a state that will tax forgiven student loans how much youll owe depends on your state tax rate. For example if 70 of your car use was for business and 30 for personal affairs then you can only deduct 70 of the car loan interest from your tax returns. You cant even deduct depreciation from your business car because thats also factored in.

Typically deducting car loan interest is not allowed. In order to deduct the interest you must itemize. However for commercial car vehicle and.

Heres how much state taxes could cost you. This means that if you pay 1000. If youre an employee working for someone else you cant deduct auto loan interest expenses even if you use the car 100 for business purposes.

In short the answer is no.

Are Home Equity Loans Tax Deductible Nerdwallet

Publication 936 2021 Home Mortgage Interest Deduction Internal Revenue Service

Can A Personal Auto Loan Be Tax Deductible

Interest On Home Equity Loans Is Still Deductible But With A Big Caveat The New York Times

Car Leasing And Taxes Points To Ponder Credit Karma

Driving Down Taxes Auto Related Tax Deductions Turbotax Tax Tips Videos

Auto Loan Calculator Estimate Monthly Car Payments Online For Free

Is Buying A Car Tax Deductible In 2022

Car Loans For Teens What You Need To Know Credit Karma

Are Medical Expenses Tax Deductible

Solved 1 Sales Tax Licensing And Other Fees Typically Add Chegg Com

Giving Employees A Company Car Here S The Tax Implications Wegner Cpas

Solved Where To Enter Car Loan Interest

:max_bytes(150000):strip_icc()/when-leasing-car-better-buying.asp_final-10bbb582c2f74c2b9c4eafcc6fbab0bd.png)

Pros And Cons Of Leasing Or Buying A Car

Is Car Loan Interest Tax Deductible Lantern By Sofi

How To Take A Tax Deduction For The Business Use Of Your Car

:max_bytes(150000):strip_icc()/ShouldYouConsiderBuyingaRentalCarJan.42022-1b87ee6e66204f9a870f4247505b520f.jpg)